1. Review your insurance policies

The first thing to do is to understand your insurance need. There are various Life Insurance plans available in the market which vary from Protection to Savings to Child Plans. You need to understand what your need is and select a plan accordingly.

Term Plans however are the most bought Life Insurance Plans online as they are Pure Protection Plans and easy to understand and extremely important to have; if you have any dependents. You can visit the Kotak Life Insurance website to know more about it.

2. Decide on the amount of cover you need

How much do you contribute to the family income? How many dependents do you have? What are your family expenses? All these questions need to be answered before you decide on how much cover you should opt for while buying a Life Insurance Plan. Ideally as a thumb rule you should be insured for at least 10 times your annual salary. You can calculate the exact amount on a HLV calculator which you can find online.

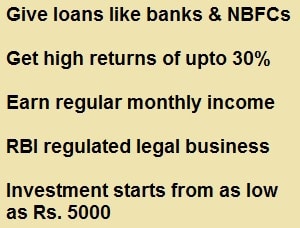

3. Compare various plans online

Before you buy a Life Insurance Plan don’t forget to compare the various plans available online. You can do this to know the premium amount for your coverage for different plans. This will help you know more about the Insurance Plans in the market and how much they charge

4. Calculate your premium

Today, if you opt for buying a Life Insurance Plan online you can calculate the premium amount you need to pay for your coverage. You can also know the various payment options and hence understand the product better. You can visit the Kotak Life Insurance website to calculate the premium

5. Understand your Life Insurance Plan before purchase

You need to understand your life insurance plan i.e. how your plan works, what is the amount you need to pay to continue the plan, how to make a claim for your payout in case of an unfortunate event and so on. Having proper knowledge about the product and the technical requirements is very important. You can know more about the claims process on the following video

6. Review your Life Insurance Policy every few years

Make sure that you take a look at your insurance policy every few years. Keep updating any changes for example your address, the nominees, and your contact details in your policy when you review it. Hygiene checks like these are a good practice to follow so that your policy is always up to date.