Loan Against Property (LAP) is a loan that is given against property as collateral. The loan amount depends on the value of the property and is generally 40% to 60% of the property value. The loan is available against pre-owned residential properties, commercial properties or other properties like schools, hospitals, industrial plots etc. Taking a loan against property allows you to borrow against a fixed and illiquid property without having to sell it, thus it provides you liquidity for short term or long term use.

The eligibility for a loan against property (LAP) is detailed below

Loan Against Property is available to an applicant after assessing his/her repayment capacity which is affected by factors like the age of the applicant and the co-applicant/s, their income/s, financial stability, credit score, employment status and some other factors too. The value of the property against which the loan is sort also plays a crucial part in deciding if a LAP will be sanctioned by the lender and also the Loan to Value (LTV) ratio.

LAP is available to salaried, self-employed, professionals and non-individuals like firms and private and public limited companies. For all categories, except the non-individual (where age limit does not apply), the age limit for an individual to get a loan is minimum 25 years and the maximum age on loan maturity can be 60 years. For all categories, occupational stability needs to be a minimum 3 years, for non-individuals, 2 years cash profit is required. Income eligibility for salaried is Rs. 2,40,000 per annum, for self-employed it is Rs. 2,50,000 and for others it is Rs. 3,00,000 per annum.

Some Other Features of a LAP

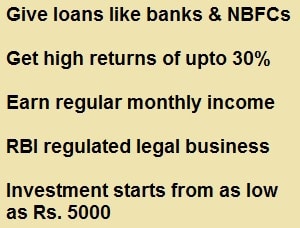

The loans may be available at fixed or floating rate for a period ranging 12 to 180 months. The loan value ranges from Rs. 5 lakhs to Rs. 5 crores. The interest rates generally range from 12% to 15% depending on the credit assessment done by the lender and also on the property that is being pledged. A non-refundable processing fee is charged for processing a LAP.

A foreclosure penalty of 4% is charged in case of a closure within one year of taking the loan; foreclosure after one year attracts a penalty of 2% of the outstanding amount. A prepayment of 25% of the loan or less can be made without any charges; a prepayment more than that attracts charges of 2% of the outstanding loan amount. One can opt to repay the loan either through an auto debit or ECS mandate or by giving Post Dated Cheques (PDCs).

Not only self-owned properties but properties owned by relatives can also be pledged as collateral for a LAP provided that all co-owners of the property agree to become co-applicants to the loan. The lender before sanctioning a loan will verify the Know Your Customer (KYC) details; for which documents related to identity proof and address proof of the customer would be required along. Documents that establish property ownership and rights must be submitted before the loan against property can be sanctioned.